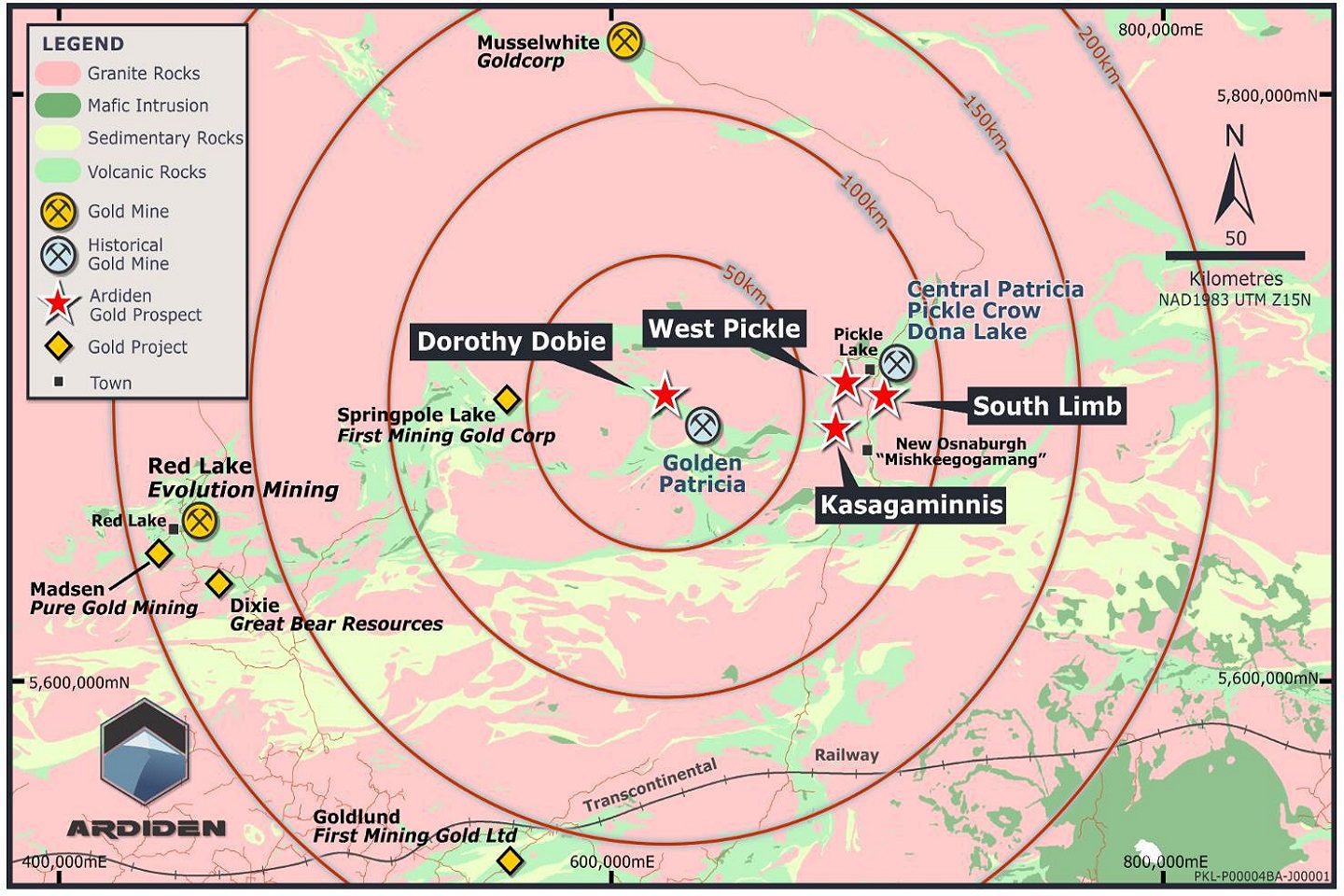

Ardiden Limited has pegged a large number of new land claims along a 100km stretch of the gold-rich greenstone belt that hosts its Pickle Lake gold project and other historical mines in Ontario, Canada. The freshly staked claims take Ardiden’s total land holdings to more than 500 square kilometres and add multiple exploration targets to its existing gold project at Pickle Lake.

The company’s Kasagiminnis deposit already holds 110,000oz of contained gold within its inferred resource of 790,000 tonnes at an impressive 4.3g/t gold.

Ardiden’s portfolio currently boasts seven gold prospects and one deposit which are dotted along a greenstone belt and the prospects are scattered amongst four historical underground mines that have yielded more than 3Moz gold over time.

The additional leases will no doubt provide a pipeline of prospects to chase alongside Ardiden’s plans for further drilling in search of potential resource upgrades at Kasagiminnis. Management said the additional landholdings are strategic in nature and provide Ardiden with a compelling gold portfolio nestled alongside the Red Lake Mining District.

Ardiden Limited CEO, Rob Longley said: “The ground holding now extends over more than 100km of highly prospective Archean greenstone territory that provides us the best opportunity to make new and exciting discoveries. What is significant about the increased landholding is the potential of the overall belt as one of the best jurisdictions in which to invest and explore for new high-grade gold deposits using modern exploration techniques and geophysical analysis - we are very excited about what the future holds.”

Whilst it is 160km west of Ardiden’s ground, the 27Moz Red Lake Gold Camp operated by Evolution Mining is within the same geological province, the Uchi Sub-province and Ardiden said the greenstone belt is vastly under-explored.

Gold is the belle of the ball right now, not only because of its record high prices but also because of its safe haven outlook in uncertain times created by health scares such as the Coronaviris.

Ardiden would appear to be in the right place at the right time in the right commodity – now for some success with the drill bit.

Is your ASX listed company doing something interesting ? Contact : matt.birney@businessnews.com.au