Minority shareholders in aspiring iron ore miner Flinders Mines expressed frustration at today’s AGM over its proposed deal with infrastructure company BBI Group, accusing their board of trying to push through a deal without offering complete details.

Minority shareholders in aspiring iron ore miner Flinders Mines expressed frustration at today’s AGM over its proposed deal with infrastructure company BBI Group, accusing their board of trying to push through a deal without offering complete details.

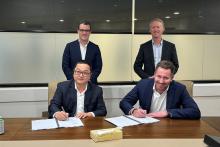

BBI Group entered into a non-binding agreement with Flinders Mines in September to deliver debt and equity financing to its Pilbara iron ore project (PIOP).

It follows long-running efforts by Flinders to develop its mine, which will rely on a new port and rail line that BBI is aiming to build.

Under the agreement, Flinders would retain control of the project until a final investment decision, at which point it could either elect to convert its shares to revenue or royalties or free carry 60 per cent of its shares through the project’s construction and commissioning.

New Zealand-based Todd Corporation, which holds 56 per cent of shares in Flinders Mines as well as 90 per cent of shares in BBI Group, would loan $5 million as part of the agreement, as well as a $6 million rights issue for capital.

While an independent review of the deal by PwC said the deal was the most favourable option for pursuing the project, shareholders were aggrieved as chief executive and former managing director David McAdam repeatedly declined to provide specific details of the deal, citing ASIC and ASX approval.

The opposition from minority shareholders could possibly stall passage of the deal since Todd Corporation, given its majority stake in both BBI Group and Flinders Mines, will not be able to vote.

“You’re not going to provide the minority shareholders with much of the detail until the proposal’s been put to ASIC and the stock exchange, and you’ll have, it seems to me, a very detailed, almost complete proposal,” one shareholder said.

“At that point, the minority shareholders … will decide to vote yes or no for it.

“If you vote no, haven’t you spent a lot of time and money and held up this process?

“If you engage minority shareholders earlier to have a better understanding as to the details to what they’re likely to be offered, aren’t we going to be in a better position than to vote … in favour of it?

“I think you went through the process in a very ad-hoc manner and excluded the opportunity for many shareholders to become engaged.”

In response, Mr McAdam said Flinders had acted within the regulatory guidelines and had engaged with minority shareholders.

However, he also acknowledged the company had not written directly to shareholders to inform them of relevant shareholder briefing updates.

Another shareholder shared concerns that BBI Group knew more about the deal than the minority shareholders, saying that its greater knowledge of the PIOP put them on uneven ground when it came to voting on the final deal.

In response, deputy chair Cheryl Edwardes pointed out that, given Todd Corporation’s conflict of interest, minority shareholders would have final say on the deal.

However, with 35 per cent of shareholders voting in favour of a motion to spill the board’s leadership today, it appeared non-Todd Corporation shareholders remained unconvinced of the deal’s value.

Shareholders are slated to vote on the final agreement in January 2020.

A spokesperson on behalf of Flinders Mines told Business News a deal is yet to be formalised, and the full details of the transaction will be provided to shareholders ahead of the meeting.