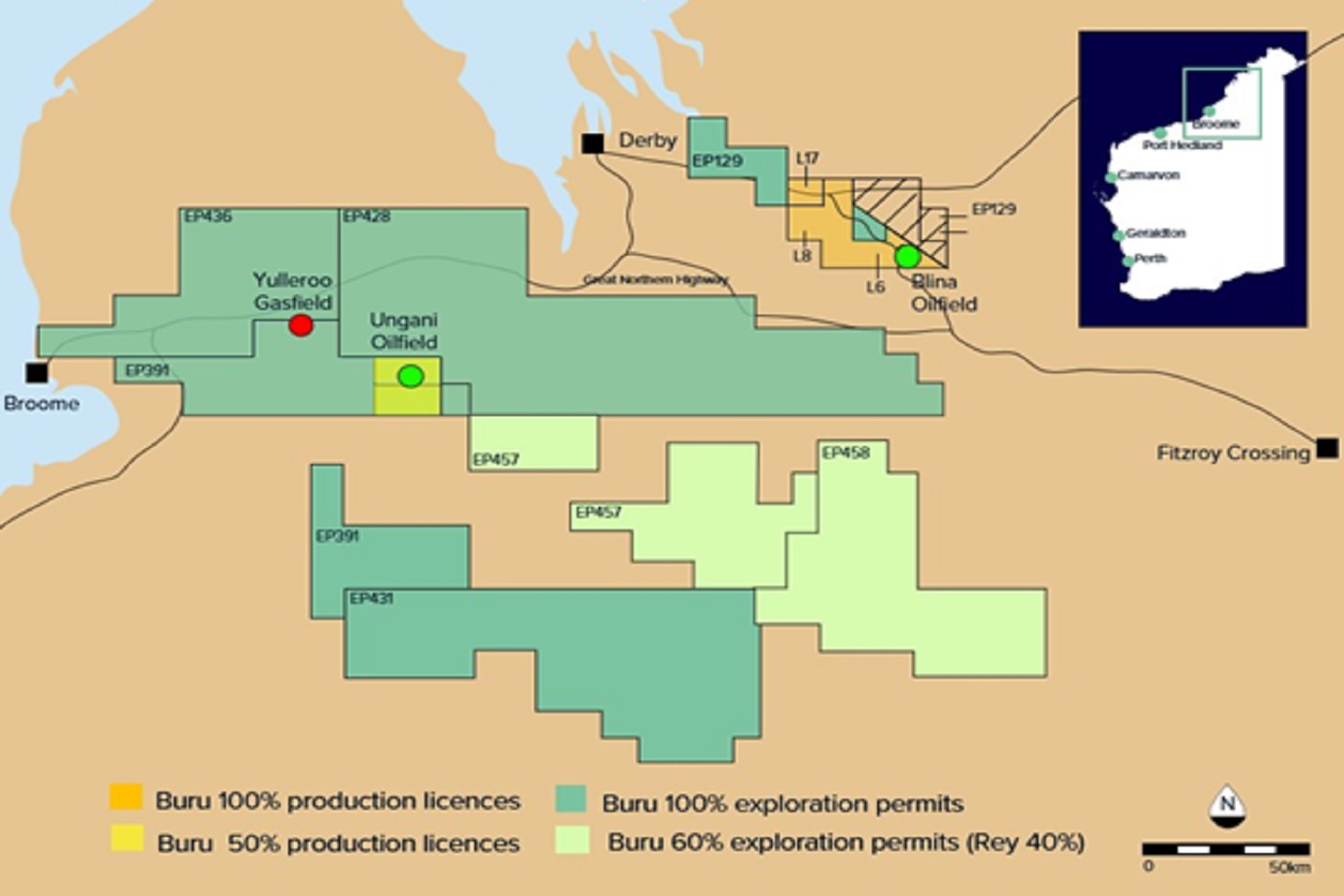

Canning Basin focussed hydrocarbon producer and explorer, Buru Energy, has a number of balls in the air for next year as it seeks to develop its range of gas and liquid hydrocarbon plays in the Canning Basin. Buru is sitting on 5.5 million acres of development and exploration permits and it is already turning out 1,400 barrels of oil per day at its flagship Ungani oilfield near Broome.

Canning Basin focussed hydrocarbon producer and explorer, Buru Energy, has a number of balls in the air for next year as it seeks to develop its range of gas and liquid hydrocarbon plays in the Canning Basin. Buru is sitting on 5.5 million acres of development and exploration permits and it is already turning out 1,400 barrels of oil per day at its flagship Ungani oilfield near Broome.

The Ungani oilfield hosts two production wells, 6 and 7 and the ASX listed company has consistently optimised production from both wells this year resulting in an ever-increasing efficiency across the operation.

The company also said that its field production will increase when the Ungani 6ST1 well is completed.

Earlier in the year Buru achieved about $80 per barrel of oil from a sale transaction to Mitsubishi subsidiary, Petro-Diamond Singapore, provisionally invoicing the Japanese company around $2.95m for its 50% share of the product.

Buru is seeking to discover oil and gas reserves in stratigraphic traps within reef-formed carbonate rocks in the wider Canning Basin, which is essentially a series of sedimentary geological units in the southwest Kimberley region, some 2,300km north of Perth.

According to Geoscience Australia, the Canning Basin is underexplored, with only 250 wells drilled – equating to four wells per 10,000 square kilometres. The Paleozoic basins in North America average around 500 wells per 10,000 square kilometres, suggesting the WA basin is yet to be properly looked at.

Buru has been taking a good look this year with well drilling revealing that its portfolio has a wide range of rock types with proven conventional oil prospectivity.

The Ungani oilfield is a conventional oil play with over 150 kilometres of prospective dolerite identified. The Adoxa-1 oil exploration well within Ungani holds the Reeves Formation – a sequence of “good quality” sands.

Buru encountered good to excellent “shows” whilst drilling through its primary Reeves Formation target earlier in the year with live oil shows observed at surface. The well also intersected oil shows in drill cutting samples of interpreted good quality sands, at 970m and 1,565m measured depth.

During the year, Buru also revisited the Blina oilfield, near Derby in WA. The first phase of production tests on the Nullara well reservoir produced rates up to 700 barrels of clean oil per day. Buru is now analysing the data for the next stage of test work.

The Perth based company’s Yulleroo gas field has a substantial 2C contingent resource of about 714 petajoules of gas and 24.9 million barrels of associated liquids within the Laurel tight gas formation. Buru is making preparations to test the flow potential of the Yulleroo 3 well with preparations progressing on track.

It is shaping up to be an interesting new year for Buru and with so many balls in the air, just which ones will land first is anyone’s guess but one thing seems inevitable, the new year should come with more hydrocarbons for this largely frontier exploration player.

Is your ASX listed company doing something interesting ? Contact : matt.birney@businessnews.com.au