Buru Energy is a step closer to unlocking its tight gas portfolio in the Canning Basin after the Western Australian state government lifted the moratorium on fracture stimulation over existing petroleum titles.

The moratorium has been in place since September 2017 to allow for an independent scientific inquiry, which confirmed last year that fracture stimulation presented low levels of risk if properly regulated.

Management said it believed that the current regulations provide a framework where fracture stimulation can be undertaken safely and without any significant environmental impacts.

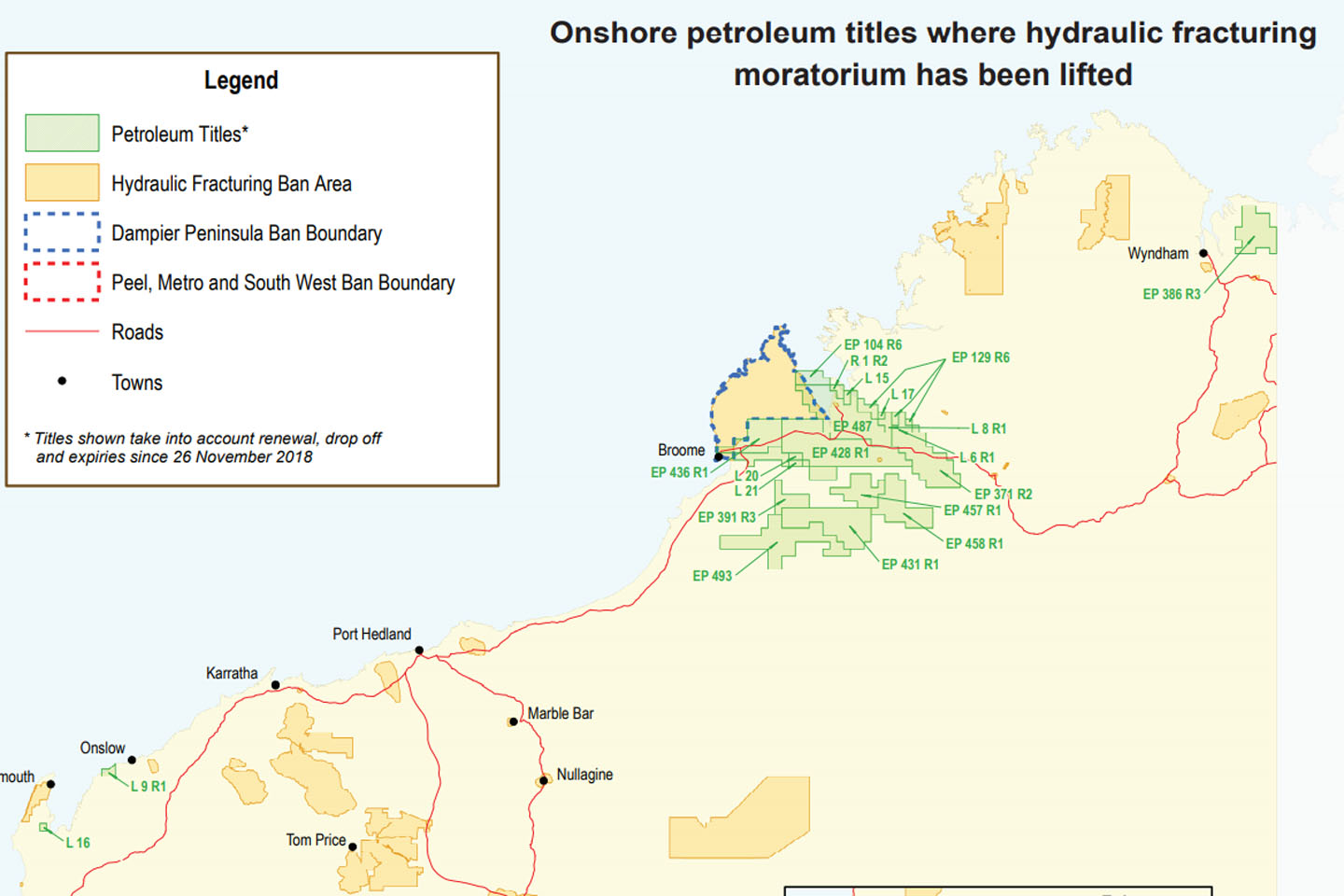

While the company has agreed to exclude the Broome township and water supply areas in its existing titles as part of the Government’s delineation of the Dampier Peninsula as a “frac free zone”, it is now able to proceed with fracture stimulation on its remaining acreage.

In addition to the Dampier Peninsula, the state government has prohibited fracture stimulation from being carried out within two kilometres of gazetted public drinking water source areas, in national parks and towns.

Traditional owners and farmers will also have the right to veto the use of fracture stimulation to produce oil and gas on their land.

Buru previously drilled four wells at its onshore Yulleroo gas field in the Canning Basin.

It also carried out a trial fracture stimulation of the vertical Yulleroo-2 well, which flowed “sweet” gas with no hydrogen sulphide, negligible carbon dioxide and more than 10% associated liquified petroleum gas.

The company estimated that the Yulleroo gas field contained 2C contingent resources of about 714 petajoules of gas and 24.9 million barrels of associated liquids within the Laurel tight gas formation.

The Laurel formation is interpreted to contain a major basin-centred gas accumulation in the Canning Basin.

While Buru’s current plans are focussed on the region’s conventional oil potential, it has also flagged that it may drill a well to test the conventional gas resources at the Yulleroo gas field.

Is your ASX listed company doing something interesting ? Contact : matt.birney@businessnews.com.au