Kairos Minerals is poised to drill-test a recently discovered 1km long light and heavy rare earths anomaly which has produced early results going up to 553 parts per million total rare earths oxide. The pending RC drilling program at its Roe Hills project, 100km east of Kalgoorlie also includes some tantalising results for neodymium and praseodymium reaching up to 126ppm, heavy rare earth oxides grading up to 154ppm and light rare earth oxides running up to 420ppm.

Kairos Minerals is poised to drill-test a recently discovered 1km long light and heavy rare earths anomaly which has produced early results going up to 553 parts per million total rare earths oxide. The pending RC program at its Roe Hills project, 100km east of Kalgoorlie also includes some tantalising results for neodymium and praseodymium within the Blue Jay prospect reaching up to 126ppm, heavy rare earth oxides grading up to 154ppm and light rare earth oxides running up to 420ppm.

Notably, the latest results also returned very low levels of the radioactive minerals of uranium and thorium.

With heritage approvals already at an advanced stage, the company is aiming for an initial 500m RC drilling program to test the target and provide a greater understanding of the area’s mineralogy and economic viability of any potential rare earths extraction.

Kairos Minerals managing director Dr Peter Turner said: “These are outstanding results which clearly demonstrate strong potential for a large rare earths discovery. The compelling nature of this anomaly is further underpinned by the large size, the consistency of the results, the presence of both light and heavy rare earths and the underlying granitic rock.”

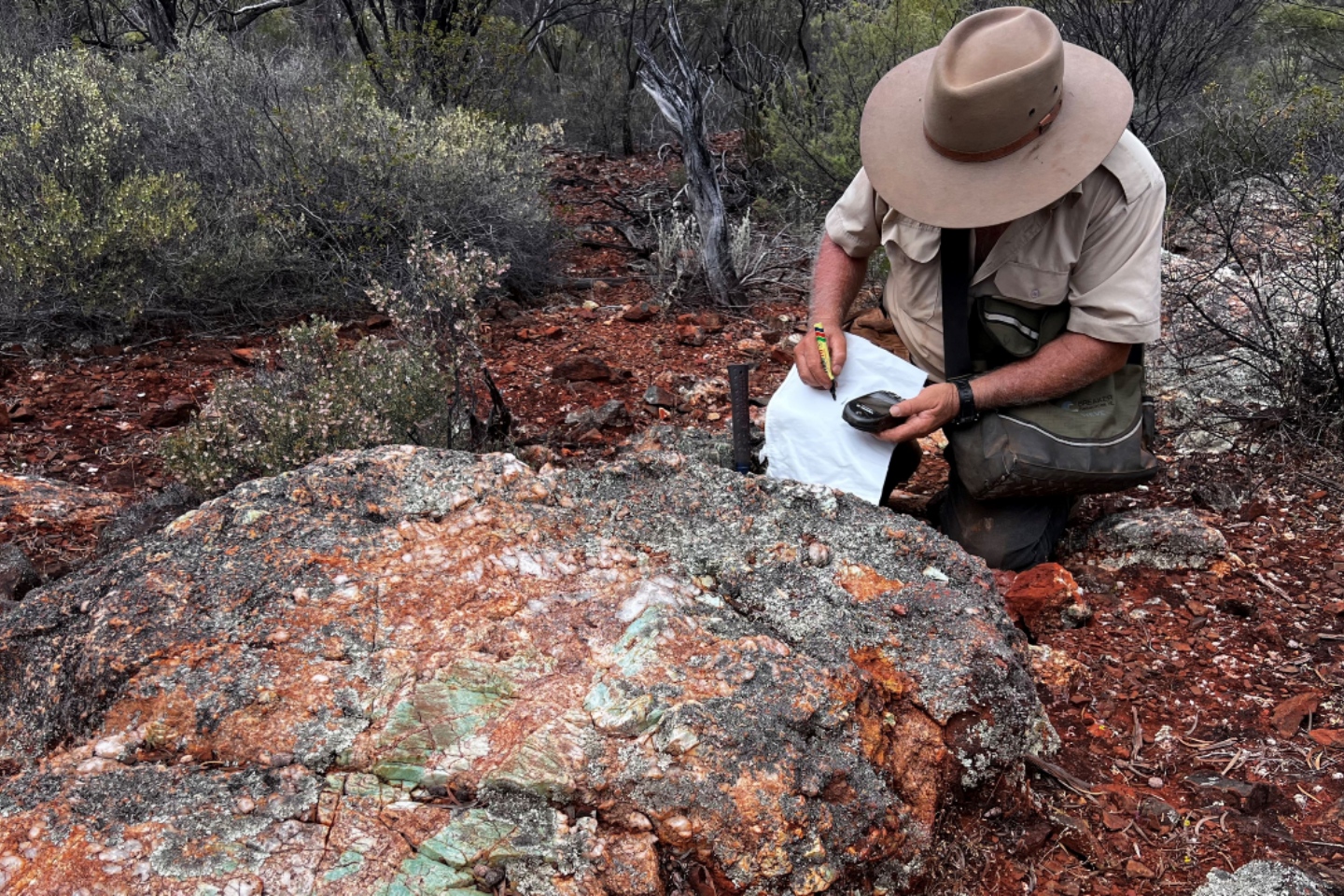

The company is already looking to join the dots at its latest target with mapping of the prospect already underway alongside a rock chip sampling program of granites and pegmatites from the area and its surrounds. Given the project has also previously been earmarked for its lithium potential, testing of the chips collected will include analysis for any additional pathfinder elements for the highly sought-after mineral that may be present.

The next chapter in Kairos’ exploration plans appears to include a solid shift on the drill rig at multiple sites across its Roe Hills project. Alongside the company’s hunt for rare earths and lithium, it is also probing for gold at its Black Cat target as well as lithium at its Crystal Palace prospect. An initial 3000m RC drilling program will target the lithium prospects, while the gold anomaly will be hit with a 1500m campaign.

The Roe Hills project covers 354 square kilometres of the Yilgarn Craton in an emerging lithium province shown to host spodumene-bearing pegmatites, as well as more traditional greenstone-hosted gold and nickel mineralisation. The company’s tenements lie between Breaker Resources’ 1.7-million-ounce Bombora gold deposit 20km to the north and Silver Lake Resources’ half-million-ounce Aldiss project to the south - all within the same north-south trending greenstone belt.

Management believes its emerging Black Cat prospect presents in a similar manner to Global Lithium’s nearby Manna deposit which contains 32.7 million tonnes at 1.0 per cent lithium oxide.

However, the sudden emergence of rare earths, which the company describes as a “nice surprise” could potentially add another lucrative string to Kairos’ bow.

With China’s vice-like grip on the world’s supply of rare earths, the rumours this week of Beijing considering imposing an export ban on the commodity in response to the United States’ decision last year to impose restrictions on exporting high-end semiconductors to Beijing would have sent jitters across the industry.

Such sabre rattling is only more likely to increase the scramble for alternative avenues of supply and with the potential for a sizeable deposit to be located on the doorstop of Kalgoorlie, Kairos could suddenly find itself in the right place at the right time.

It is only early days for Kairos, but it will be fascinating to see what they can cover once the drill bit starts to turn.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au