ASX-listed Neometals’ latest feasibility study into its Vanadium Recovery Project in Finland has shown a significant increase to the operation’s net present value compared to its preliminary investigations. The latest figures show a 40 per cent increase to pre-tax net present value up to $US323 million compared to $US230 million identified in the prefeasibility study completed in May 2021.

ASX-listed Neometals’ latest feasibility study into its Vanadium Recovery Project in Finland has shown a significant increase to the operation’s net present value compared to its preliminary investigations.

The latest figures show a 40 per cent increase to pre-tax net present value up to $US323 million on 100 per cent ownership basis compared to $US230 million identified in the prefeasibility study completed in May 2021.

Earlier this month Neometals executed an agreement to secure 50 per cent ownership of joint venture company Recycling Industries Scandinavia AB, or “RISAB” to develop the first Finnish vanadium recovery project.

The balance of RISAB equity is held by unlisted Australian mineral development company Critical Metals whilst Neometals holds approximately 19 per cent of Critical’s issued capital.

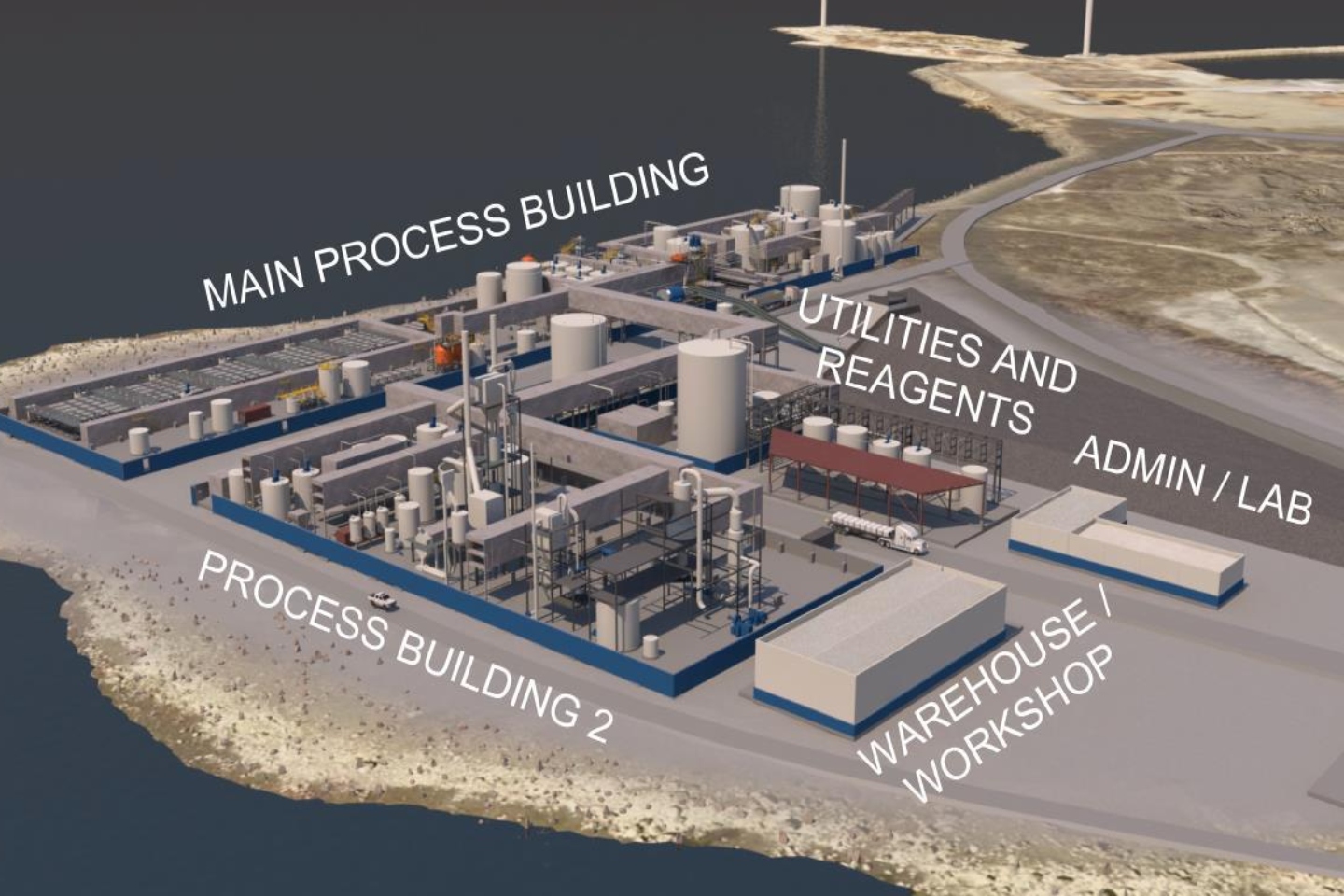

Both parties are working together to evaluate the feasibility of constructing a facility in Pori, Finland to process and recover high-purity vanadium pentoxide from vanadium-bearing steel making by-product, or “slag” generated or obtained by Scandinavian steelmaker SSAB.

The feasibility study has also highlighted an increase in average production of 19.1 million pounds per annum of potentially carbon-negative and high-purity vanadium secured through Neometals 10-year supply agreement with SSAB. This is a significant increase compared to the 13.4 million pounds per annum identified in the prefeasibility study.

The updated feasibility results are based on a 300,000 tonne-per-annum feed rate, incorporating data from a previously announced engineering cost study. The latest study highlights a life-of-plant revenue of more than $US2 billion, a pre-tax internal rate of return of 24.8 per cent and an average net operating cost of recovered vanadium at $US4.19 per pound down from $US4.25 per pound in the prefeasibility study.

Neometals Managing Director, Chris Reed said: “With our newly expanded 300ktpa feed rate and some updated data since the last cost study, the FS highlights the significant opportunity that exists. Specifically, that opportunity is to deliver some of the highest-grade, lowest-cost vanadium chemicals globally with a carbon-negative footprint.”

Vanadium has traditionally been used as a hardening ingredient in steelmaking but is increasingly being sought after in the battery industry where it is touted as having a lucrative future in grid-scale power storage.

The metal’s benefits over lithium-ion in such uses include favourable costs at scale, safety, longevity and consistency of power delivery over longer periods. Steel slag currently supplies the bulk of the world’s vanadium needs, according to global industry group Vanitec.

Neometals has also executed a technology licence for its slag processing intellectual property to RISAB for a 2.5 per cent gross sales royalty and provided SSAB a guarantee for an amended feedstock supply agreement for the slag. Under the binding deal SSAB will supply two million tonnes of slag with RISAB having the first right to purchase additional tonnes when available.

The new slag supply agreement still contains the condition that a project investment decision must be made by 30 June 2023, but removes the requirement to be in production by 31st December 2024

Neometals says the new recovery operation offers an opportunity to extract high-grade vanadium from slag without the need for a mining operation’s costs and carbon footprint.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au