Perth based Triton Minerals have indicated they will focus on getting their Ancuabe prospect in Mozambique into early stage high grade production this year.

The company says Ancuabe is expected to offer a reliable and sustainable source of premium flake graphite and has the added benefit of attracting high basket price margins whilst only having low capital requirements.

The prospect is also only 50km from the deep water port of Pemba which has an operating shipping container facility.

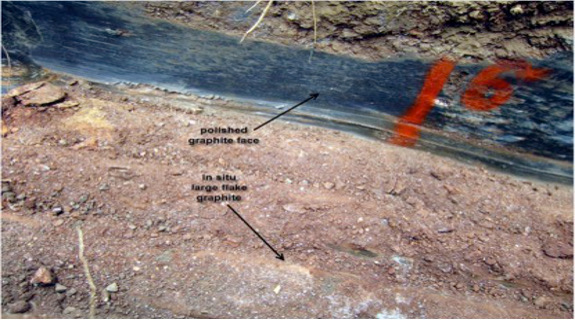

Exploration to-date at Ancuabe has unearthed some of the best graphite results in Africa with Jumbo and Super Jumbo graphite flakes occurring regularly across the prospect.

The company says that 72% of flakes discovered at Ancuabe are greater than 300 microns in size and that 43% are greater than 500 microns, at grades of more than 98% Total Graphitic Carbon.

Triton CEO and Managing Director, Garth Higgo, said “Although only around 10% of the Ancuabe tenements have been explored so far, the initial drilling results and metallurgical test work results are extremely positive.

The significance of these results indicates that Ancuabe has the potential, subject to additional work, to clearly differentiate Triton from all other graphite development projects.

In comparison with other East African graphite projects with deposits in the jumbo and super jumbo graphite flake category, and given the premium prices that high purity super jumbo can attract, the investment and development opportunity for Ancuabe is compelling.”

In a further sign that Triton’s focus will be all about production this year, the company has also signalled they are seeking to replace the current arrangements with Chinese partner Yichang Xincheng Graphite Co Ltd to co-fund a graphite processing plant in China and Mozambique.

The current 100 000 tonne per annum off take agreement with Yichang Xincheng Graphite will however remain in place.

The company points to the fact that Yichang Xincheng Graphite Co Ltd are an end user and manufacturer of expanded graphite products rather than just a trader to support the view that their off take agreement is solid.