Red Metal Ltd has secured a joint venture with Artemis Resources to accelerate exploration at its Sharon Dam IOCG target in Western Australia. The deal allows Artemis to earn 60 per cent by spending $5 million, with drilling co-funded by a state grant. The underexplored project offers shallow cover and strong geophysical signatures.

Red Metal Limited has strengthened its position in Western Australia’s emerging Madura copper province after striking a joint venture (JV) deal designed to fast-track drilling at its highly prospective Sharon Dam iron oxide copper-gold (IOCG) target.

Under the agreement, Artemis Resources can earn up to a 60 per cent interest in Red Metal’s Sharon Dam project by spending more than $5 million over three years, providing Red Metal with a clear pathway to advance the asset while limiting shareholder dilution.

The JV kicks off with an initial $400,000 drilling program, which will be jointly supported by a $220,000 grant from the Western Australian Government’s Exploration Incentive Scheme (EIS). The funding support materially lowers Red Metal’s upfront exploration costs and de-risks the first drill test of what the company believes is a standout IOCG target.

Importantly, Artemis has the option to continue earning its interest by meeting the agreed expenditure milestones or withdraw from the agreement at any stage, leaving Red Metal with flexibility and retained exposure to exploration success.

Sharon Dam is a large, previously under-drilled IOCG target defined by a strong coincident magnetic and gravity anomaly, a geophysical signature often associated with major copper-gold systems. The target sits within a frontier exploration district that has seen limited modern exploration despite its compelling geological setting.

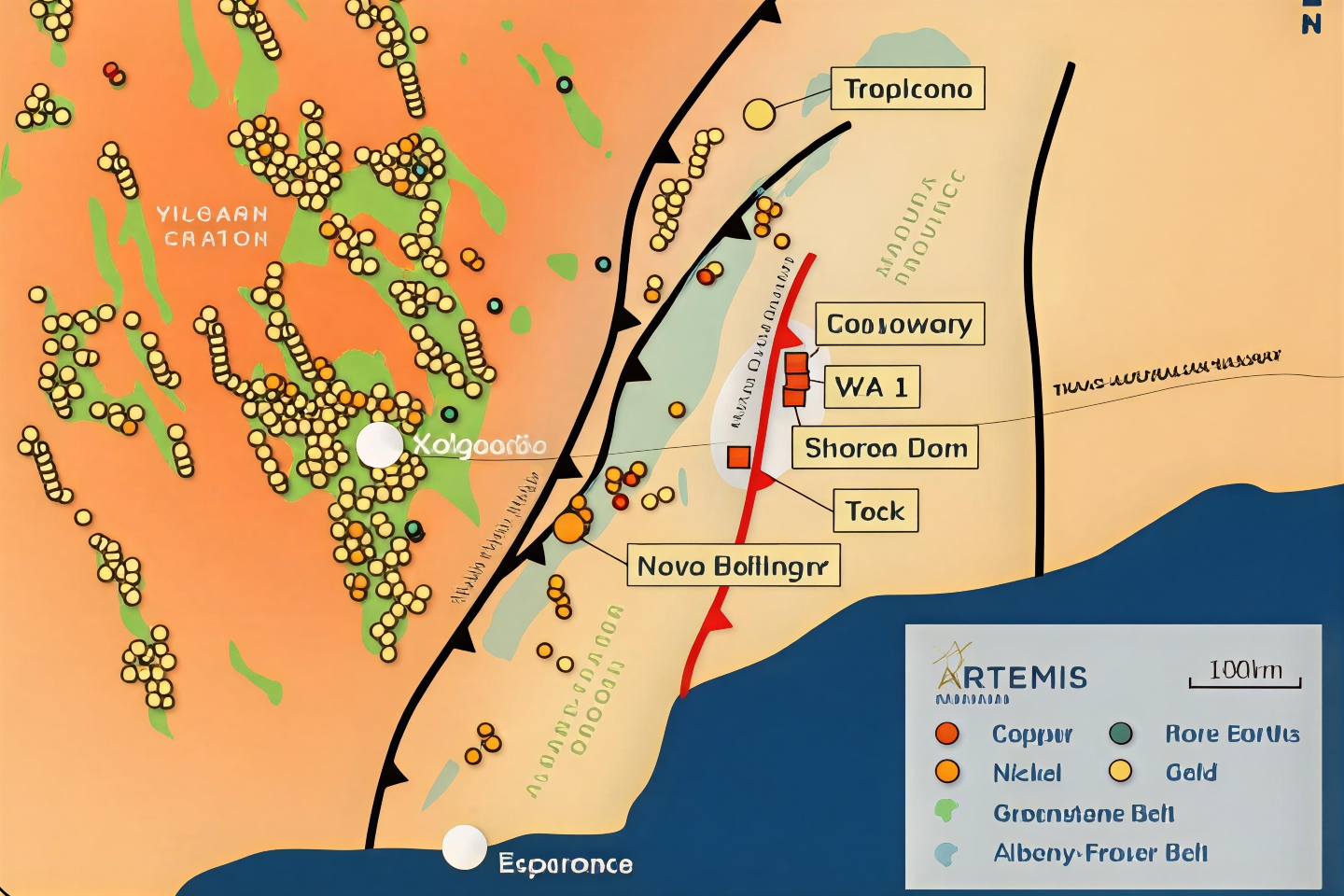

The project lies within the broader Madura Crustal Boundary district, an emerging province interpreted to host multiple intrusive bodies. Red Metal’s ground benefits from relatively shallow cover, estimated at less than 250 metres and offers a cost-effective exploration environment compared with deeper IOCG systems elsewhere in Australia.

The granted tenement also has established access to drill sites, with drilling planned for March next year, subject to heritage clearances. Red Metal believes the combination of strong geophysics, shallow cover and ready access positions Sharon Dam as a genuine near-term discovery opportunity.

Geographically, the highly prospective Sharon Dam T1 intrusion lies 50 kilometres south of the Cassowary intrusion, within what is interpreted as a unique multi-intrusion belt along a major structural corridor. The setting places it within one of the last underexplored frontiers for IOCG copper and intrusion-related deposits in Australia.

While the JV expands Artemis’ footprint in the district, it is Red Metal that stands to benefit from having a well-funded partner accelerate exploration on its asset, while retaining meaningful exposure to any success.

Artemis Resources technical director Julian Hanna said: “Sharon Dam is a rare opportunity for Artemis. Not only does it tick all the boxes on technical grounds, the first hole in the centre of this compelling target will be co-funded by a substantial EIS grant reducing the funding requirement from Artemis. Our exploration team is looking forward to working closely with Red Metal on the Sharon Dam project.”

For Red Metal, the deal represents a smart strategic move by bringing in funding, technical collaboration and momentum at Sharon Dam while preserving upside in a region that is rapidly gaining attention as Australia’s next IOCG frontier.

Is your ASX-listed company doing something interesting? Contact: matt.birney@businessnews.com.au