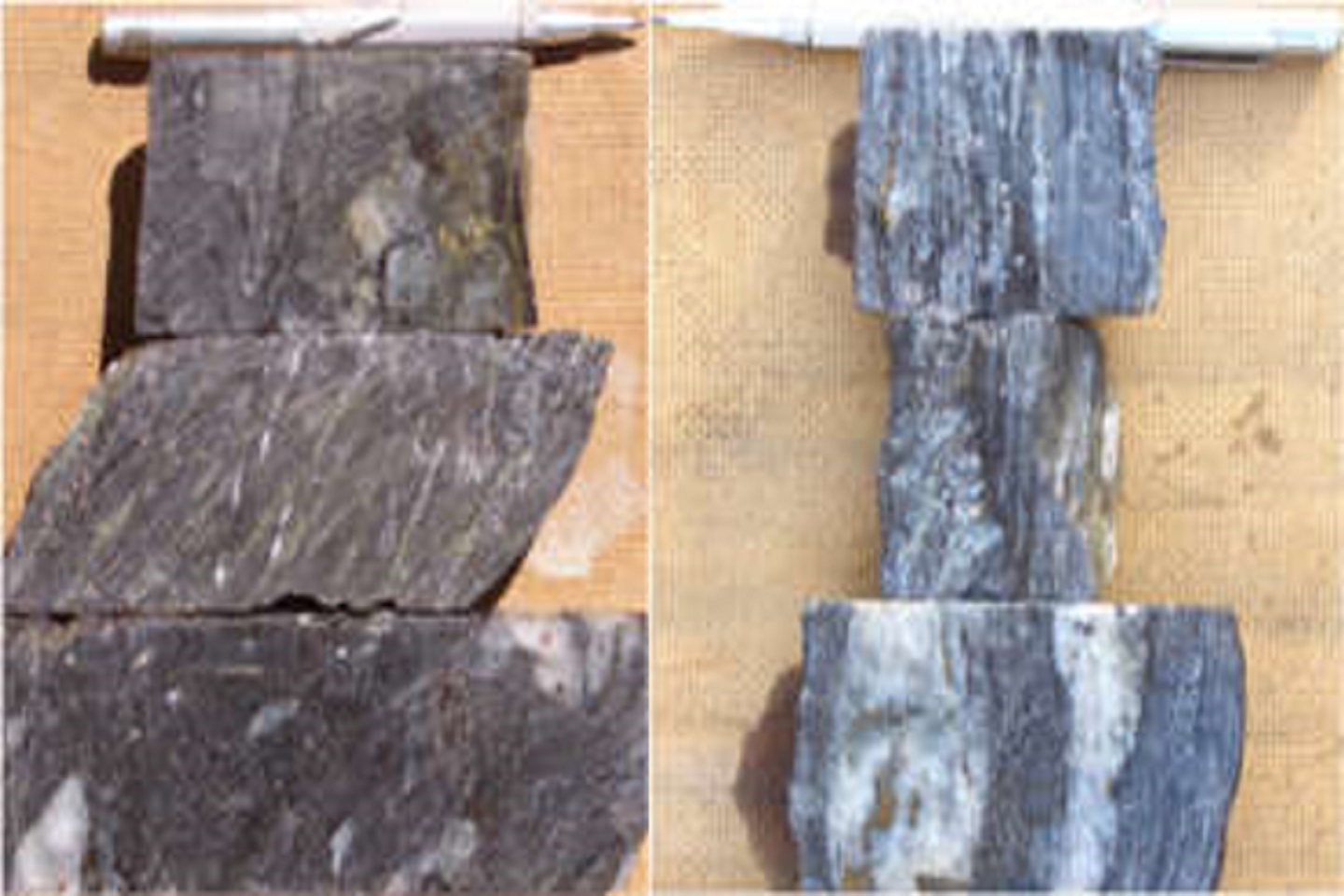

Perth based ASX-listed Brazilian explorer, Big River Gold, said this week that a usually insignificant waste mineral known as a “mica” could potentially make the company some good money at its Borborema gold project in north-eastern Brazil.

Perth-based engineering consulting group, Wave International, recently identified the potential to extract and process the micas at the project for sale as a sperate, commercially viable product.

The micas makes up approximately 30% of the volume of the Borborema ore system and carry half the gold grade.

Big River says the micas could be processed via the standard milling circuit then dewatered and detoxified during the tailings treatment process. During this part of the process, the mica minerals could be recovered by flotation or magnetic separation with minimal cost.

Testwork has been positive and supports the commercial viability of extracting the micas at Borborema according to Big River.

The world market demand for the type of mica at Borborema is estimated to be between 300,000 to 500,000 tonnes per annum at sale prices above $200 per tonne, depending on the size and quality of the flakes.

Mica-rich bulk concentrates are also sought after with world markets demanding about 3 million tonnes per year at prices of around $200 per tonne.

Mica is used in a variety of end products in the electrical industry as thermal insulation in addition to being used in rubber compounds, paints, cosmetics and lubricants.

Big River will now run further assessments to firm up the potential economic viability and recoverability of the micas at the project.

The company is on track to complete a definitive feasibility study at Borborema by the end of this year and any income source from the micas will no doubt have a curious impact on the final numbers.

Borborema currently boasts a mineral resource of 68.6 million tonnes grading 1.1g/t gold for 2.43 million ounces, from which Big River has derived an ore reserve of 42.4 million tonnes at 1.18g/t gold containing 1.6 million ounces.

An optimisation study produced in February 2018 pointed to a post-tax net present value of USD$118m and an internal rate of return of 31%, with free cash flows of USD$243m from a two million tonne per annum project over an initial mine life of 10 years.

Upfront capital costs were estimated at USD$93m, whilst the all-in sustaining production costs were estimated at just over USD$900 per gold ounce, based on a forecast gold price of USD$1,300 per ounce, which is now looking light on.

Small additional income streams, particularly unexpected ones, can sometimes have big impacts on economic studies. The poetry of converting waste rocks to hard cash will not be lost on Big River followers.

Is your ASX listed company doing something interesting ? Contact : matt.birney@businessnews.com.au