Unlisted private equity backed Barton Gold has received an all-important nod of approval from a South Australian Government authority tasked with approving or rejecting non-military use of its minerals rich military land in South Australia. Barton said this week it had secured Resource Exploration and Production Permits from the Woomera Prohibited Area Coordination Office known as “WPACO”.

Unlisted private equity backed Barton Gold has received an all-important nod of approval from a South Australian Government authority tasked with approving or rejecting non-military use of its minerals rich military land in South Australia.

Barton said this week it had secured Resource Exploration and Production Permits from the Woomera Prohibited Area Coordination Office known as “WPACO”.

The exploration permits are for 7 years and the production permits will last for 10 years and will remove a potentially significant hurdle for Barton as it heads towards a possible ASX listing early next year.

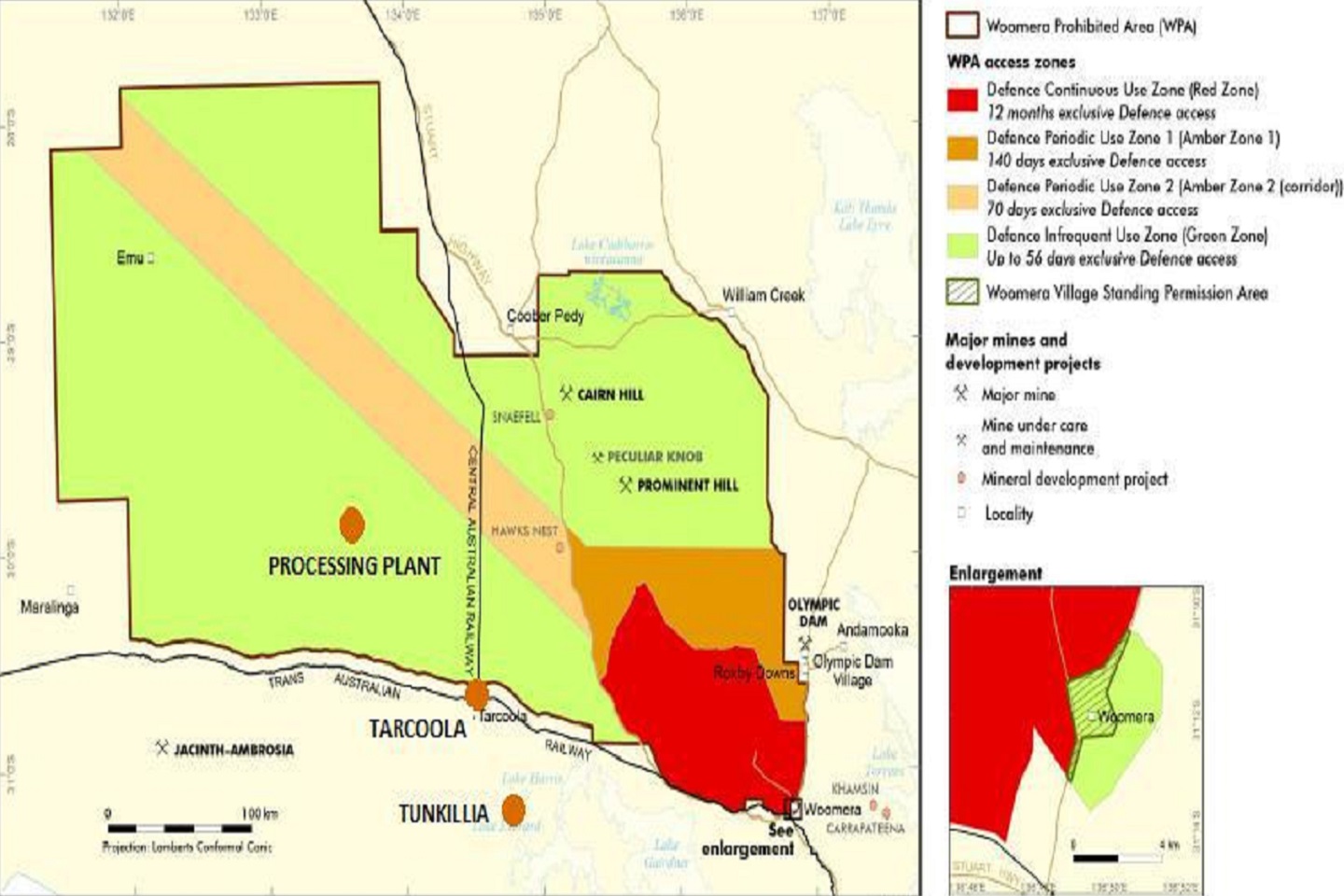

The Woomera Prohibited Area is a globally unique military testing range. It covers 122,188 square kilometres in north-west South Australia, about 450 kilometres north-west of Adelaide. It is the largest land testing range in the world and it is mainly South Australian crown land covered by pastoral leases, exploration and mining tenements and native title.

The Woomera Prohibited Area is also highly prospective for minerals with the South Australian Government and Geoscience Australia previously estimating that about $35 billion worth of iron ore, gold and other mineral resources could potentially be exploitable from within the area over the next ten years.

Non-military uses in the prohibited area must be approved by the WAPACO however.

The Woomera Prohibited Area, which is also home to some large mines such as the Prominent Hill copper-gold and Olympic Dam mines, takes in the northern portion of Barton’s Tarcoola project and its processing infrastructure at the now mothballed Challenger underground mine.

Managing Director of Barton Gold, Alex Scanlon said: “We are pleased to receive these important approvals as part of our work and planning for the extension and restart of the Tarcoola mine.”

Barton was formed to pick up a bundle of prospective gold assets in South Australia from ASX-listed WPG Resources, who went into Administration in July 2018.

The company is planning to kick start the Perseverence open pit at Tarcoola initially and treat its ore at the old Challenger plant before investigating a host of other options it has available to it.

They include mining its Tunkillia project about 80km to the south east of Tarcoola or re-starting the Challenger underground mine – something that Barton says it is not in a hurry to do and does not need to do in the short term to make money.

Tunkillia is thought to be the largest undeveloped gold only resource in South Australia.

The known residual defined resource at Tarcoola is currently 45,000 ounces grading 1.7 grams per tonne gold however WPG said it was mining 4.53g/t gold in the March 2018 quarterly just before it fell over due to complications around the Challenger underground mine.

Historical intersections under and adjacent to the current pit at Tarcoola include 5m grading 20.6g/t, 2m grading 33.8g/t, 4m grading 14.8g/t and 6m grading 43.6 g/t gold.

The company is currently undertaking a $3M seed capital raise ahead of its listing with PARQ Capital managing the transaction.

Is your ASX listed company doing something interesting ? Contact : matt.birney@businessnews.com.au