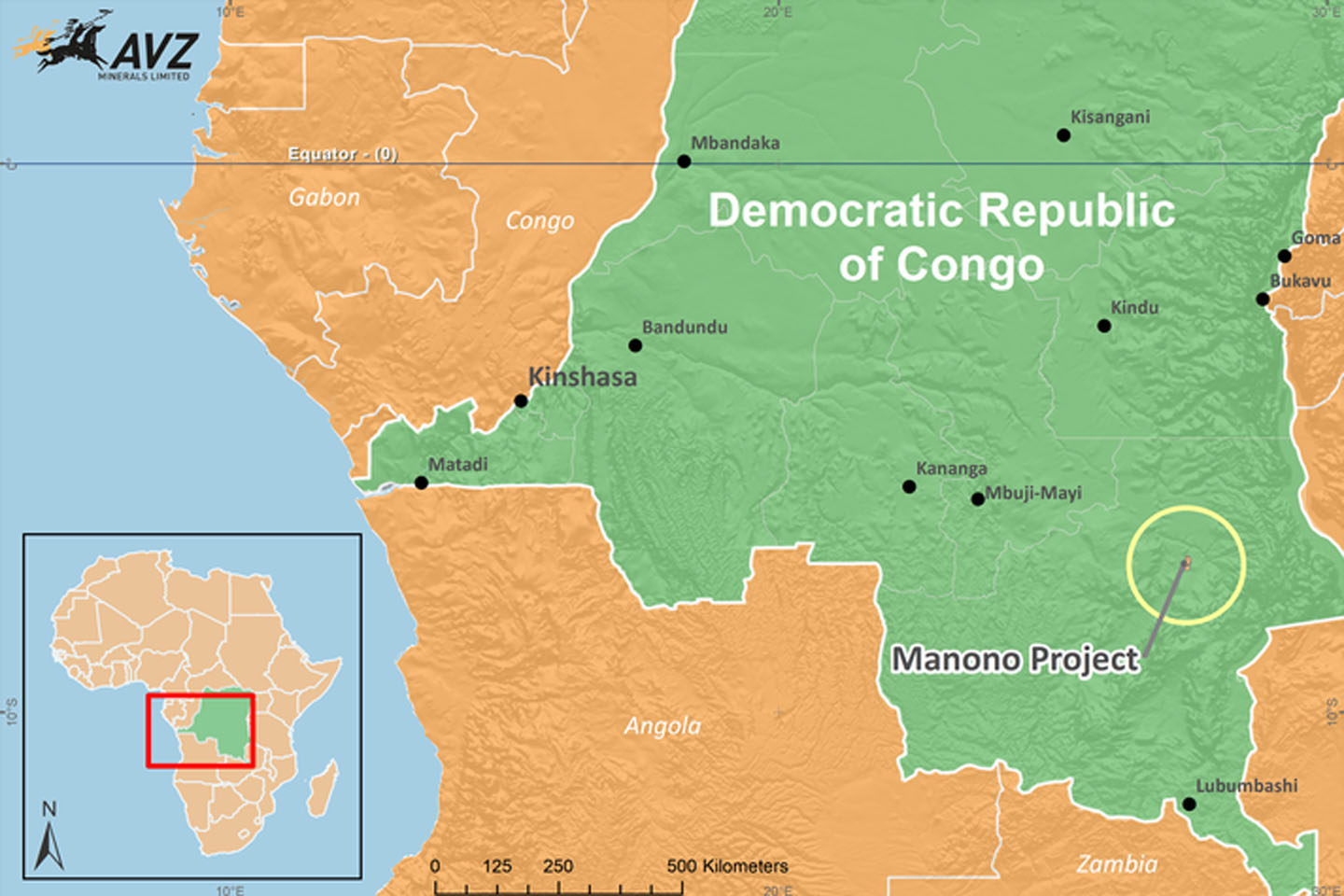

Lithium-focussed AVZ Minerals has reached an alliance with China’s Zhejiang Huayou Cobalt Co. Ltd to help drive the DFS for its giant Manono lithium-tin project in south-eastern Democratic Republic of the Congo.

Huayou Cobalt Group is one of the world’s largest manufacturers of cobalt chemicals for use in batteries and has extensive in-country experience with established cobalt mining and processing operations within the DRC.

It is also a 9.47% shareholder in AVZ.

Under the strategic relationship agreement, the company will be able to draw on Huayou’s experience in the DRC and mainland China.

Huayou will also be able to provide advice and assistance relating to project financing, offtake financing, strategic services and the cost-effective transport of product to final recipients.

AVZ Managing Director Nigel Ferguson said: “We believe that bringing Huayou’s tremendous mining expertise to bear on the DFS, financing and offtake negotiation will accelerate the commercialisation of the largest lithium ore body on the ASX and yield tremendous value for AVZ shareholders.”

Huayou President Hongliang Chen added: “Huayou is pleased to have joined AVZ in a Strategic Relationship to progress the Manono lithium and tin project. This project is one of the standout development projects globally in our view. It has the potential to deliver a premium grade product to market and we expect to work closely with AVZ to maximise the potential of the Manono project.”

Manono has a huge resource of 400 million tonnes grading 1.65% lithium oxide and 715 parts per million tin.

Notably, over 67% of AVZ’s tonnes at Manono are already classified at the more confident “measured and indicated” resource status.

A recent extended Scoping Study indicated that a 5 million tonne per annum project would generate pre-tax NPV of USD$2.63b at an IRR of 64%, with a CAPEX ranging between USD$380m and USD$400m, inclusive of a USD$78m contingency.

Payback is expected to be about three years whilst mine life is clocked at 20 years.

This does not factor in the value of the tin and tantalum by-products of a mining operation at Manono, which could appreciably offset a lot of the mine operating costs.