West African focussed gold developer, Azumah Resources, has completed a scoping study for its Bepkong “underground” resource in north-western Ghana, saying the operation could spit out 154,000 ounces of gold, producing a post-royalty, pre-tax cash flow of USD$32m over 4.5 years.

This is on top of the proposed open-pit mining operation at the Wa gold project, which has a pre-tax net present value of USD$177m and an internal rate of return of 35%, with a payback of the USD$117m establishment capital costs expected in 1.6 years.

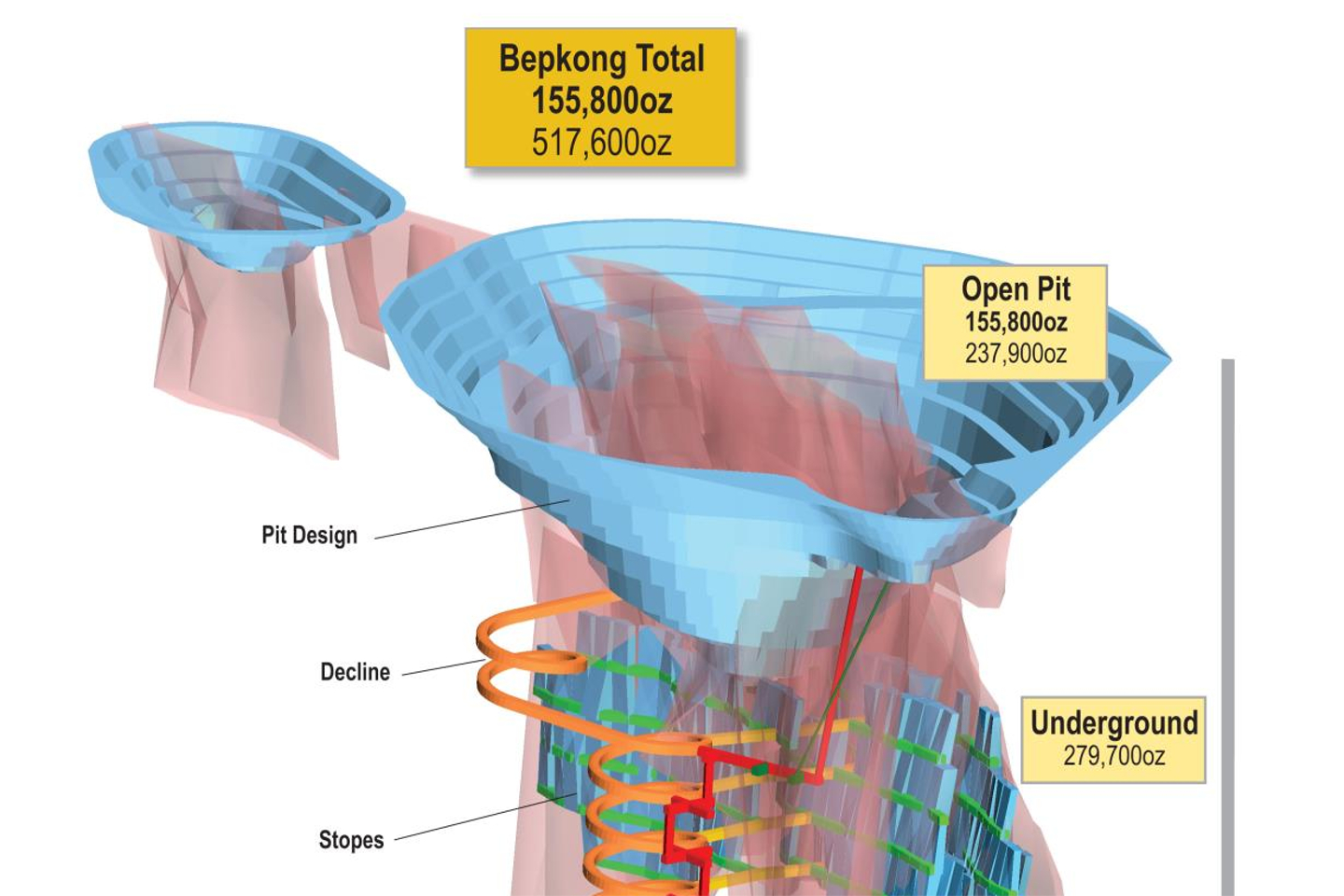

Underground development of the Bepkong deposit could commence towards the end of development at that deposit’s open cut, which is scheduled during Year 2 of the initial 11-year mine life for the broader Wa gold project open-pit mining operations.

Capital costs for the proposed Bepkong underground mining are incremental to the open pit capital requirements and ring in at a reasonable USD$36m, due mainly to the initial underground mine development requirements and diamond drilling expenses to prove up resources.

Beyond that, there is an estimated USD$78m for mining costs and USD$29m of processing costs associated with the treatment of the underground ores.

However, given the accelerated payback period under two years for the open-pit mining scenario outlined for the Wa project, Azumah might be able to self-fund some of those initial underground mining capital costs itself.

The company has already generated a global mineral resource of 2.77 million ounces of gold at the Wa project, with Bepkong holding 0.52 million ounces in its open cut and underground mineral resources.

From this, Azumah has carved out 1.03 million ounces in open ore reserves, which will mainly be sourced from the Kunche, Julie and Bepkong deposits.

In addition, the Bepkong underground gold mineralisation is not included in the company’s feasibility study for the Wa project, which is due for completion by the end of 2019.

This study is being managed by JV partner Ibaera Capital.

Azumah believes that an underground mining operation at Bepkong could provide a complementary uplift to its existing economically robust, open-cut centred Ghanaian gold project.

Managing Director Stephen Stone said: “Fast on the back of the recently reported Bepkong ‘underground’ mineral resource of 279,700oz grading 3.59g/t Au, a scoping study has indicated that an underground mining operation could provide a material boost to the already financially robust Wa gold project with an estimated production target of approximately an additional 154,000oz and pre-tax, post-royalty revenue of approximately USD$32 million.”

“This is a tremendous development for the current 1Moz ore reserve, open-pit based project as the Bepkong underground mineralisation is a recent discovery and is not included in the project feasibility study, due for completion by year-end.”

“With the prevailing gold price well above the USD$1,300 per oz used in determining ore reserves and revenues for the feasibility study and revenues for the scoping study, the business case for development just gets stronger.”